Payment Methods

Standby Letter of Credit – SLOC written on a computer key

A standby letter of credit (SBLC) is a risk management tool used in international or domestic transactions where the seller and buyer are not familiar with each other. It is designed to protect both parties from various risks such as bankruptcy, insufficient cash flows, and other adverse events that can affect the transaction.

In case of an adverse event, the bank issuing the SBLC promises to make the required payment to the seller as long as all the conditions of the SBLC are met. This payment is considered to be a form of credit, and the buyer is responsible for paying the principal plus interest as agreed with the bank. The SBLC offers a level of security and assurance to both the seller and buyer in such transactions.

Standby Letter of Credit Explained

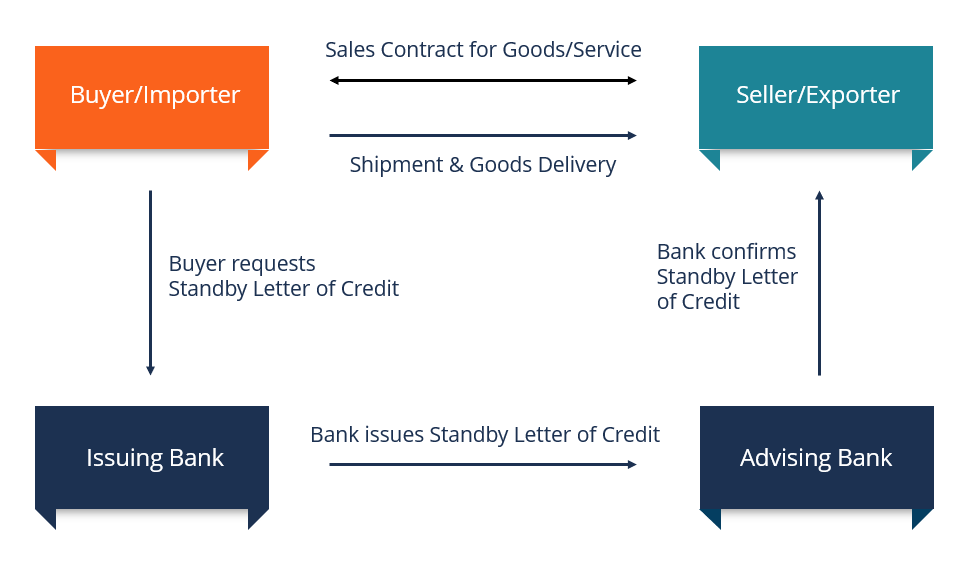

A standby letter of credit (SBLC) is often required in international trade to help a business obtain a contract. In a transaction where the parties involved do not know each other, an SBLC promotes the seller’s confidence in the agreement. It serves as a sign of good faith, demonstrating the buyer’s credit quality and ability to make payment for goods or services even in case of an unforeseen event.

When setting up an SBLC, the buyer’s bank performs an underwriting duty to verify the credit quality of the buyer. Once the buyer’s bank is satisfied that the buyer is in good credit standing, it sends a notification to the seller’s bank, assuring its commitment of payment to the seller if the buyer defaults on the agreement. This notification provides proof of the buyer’s ability to make payment to the seller.

How an SBLC Works

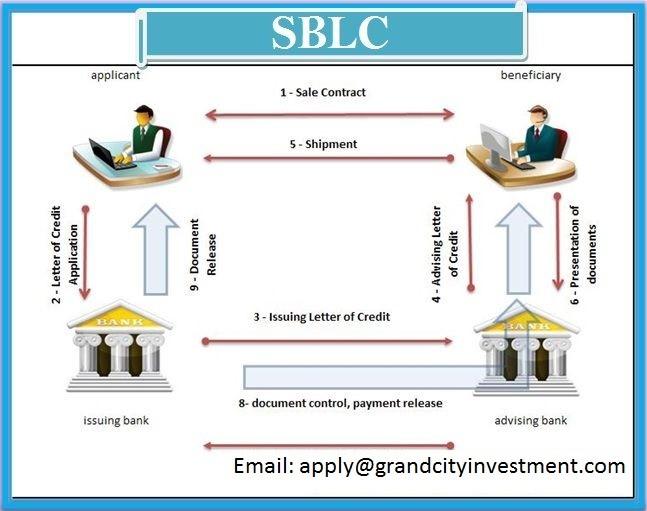

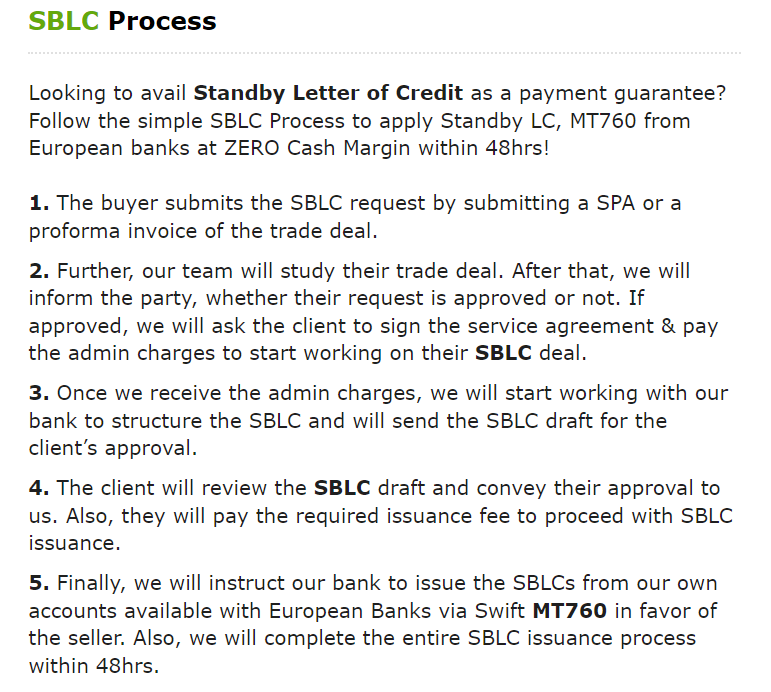

The process of obtaining an SBLC (Standby Letter of Credit) is similar to applying for a loan. It starts when the buyer applies for an SBLC at a commercial bank. The bank will then perform its due diligence on the buyer, assessing their creditworthiness based on their past credit history and most recent credit report. If the buyer’s creditworthiness is in question, the bank may require them to provide collateral in the form of an asset or funds on deposit before approval.

The amount of collateral required will depend on the level of risk involved, the strength of the business, and the amount secured by the SBLC. The buyer will also have to provide information about the seller, shipping documents required for payment, the beneficiary’s bank, and the validity period of the SBLC.

Once the commercial bank has reviewed the documentation, it will provide an SBLC to the buyer. The bank will charge a service fee of between 1% to 10% for each year the financial instrument remains valid. If the buyer meets their obligations in the contract before the due date, the bank will terminate the SBLC without further charge.

However, if the buyer fails to meet the terms of the contract due to various reasons, such as bankruptcy, cash flow crunch, dishonesty, etc., the seller is required to present all the necessary documentation listed in the SBLC to the buyer’s bank within a specified period. The bank will then make the payment due to the seller’s bank.

Types of Standby Letter of Credit

- Financial SBLC

The financial instrument known as SBLC provides a guarantee of payment for goods or services, as agreed upon in a contract. For instance, if a crude oil company exports oil to a foreign buyer with the expectation that payment will be made within 30 days from the date of shipment, but the buyer fails to make the payment by the due date, the seller can collect the payment for the delivered goods from the buyer’s bank. As it is a form of credit, the bank will recover the principal amount plus interest from the buyer.

- Performance SBLC

A performance-based Standby Letter of Credit (SBLC) ensures that a project is completed within the given timeline as per the contract. If the bank’s client fails to complete the project within the agreed time, then the bank promises to pay a particular amount of money to the third party involved in the contract. Performance SBLCs are mainly used in projects that have a fixed timeline, such as construction projects. The payment serves as a penalty for delays in completing the project, and it is used to compensate the customer for the inconvenience caused or to allow another contractor to take up the project.

Summary

A standby letter of credit (SBLC) refers to a legal instrument issued by a bank on behalf of its client, providing a guarantee of its commitment to pay the seller if its client (the buyer) defaults on the agreement.

An SBLC is frequently used in international and domestic transactions where the parties to a contract do not know each other.

A standby letter of credit serves as a safety net by assuring the seller that the bank will make payment for the goods or services delivered if the buyer fails to make the payment on time